28+ mortgage default rates 2021

In April 2021 the delinquency and transition rates and their. Learn More to Start Today.

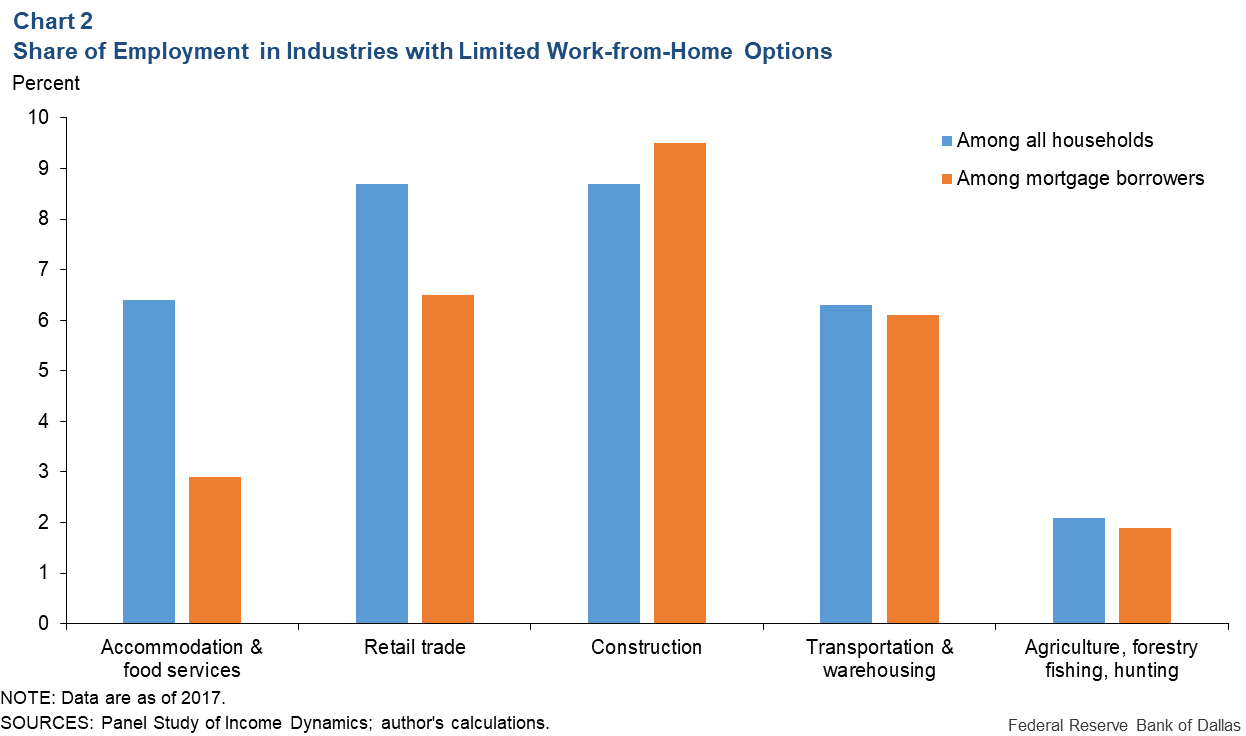

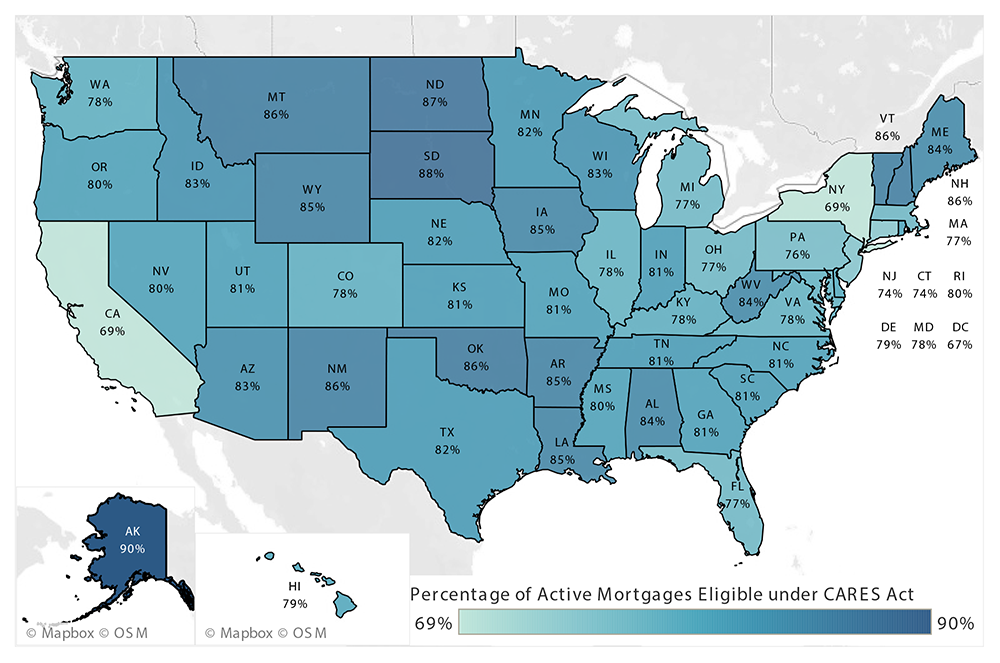

Cares Act Likely To Blunt Mortgage Delinquency Rate Increase Dallasfed Org

Free Info Kit For Homeowners Age 61.

. At 036 the balance-weighted first-mortgage default rate was up from 035 in April and 028 a year earlier according to Standard Poors and Experian. Web To gain an accurate view of the mortgage market and loan performance health CoreLogic examines all stages of delinquency. Ad Compare the Best 2nd Mortgage Lender that Suits Your Needs at the Lowest Rates.

Web In July 2021 the US. Ad Reviewed Ranked. Web More specifically the maps show the 24-month transition rates for loans that were current and not in forbearance as of December 2020.

Web New mortgage volumes grew the most at 118 year-over-year for lower risk consumers The overall 90 consumer level delinquency rate dropped to 83 in the fourth quarter down from 116 in the. Web Total home mortgage debt in the US. Milliman Mortgage Default Index.

The current default rate of 027. As of November 2021 the serious delinquency rates for Federal Housing Administration FHA US. To estimate these transitions we use default rates from the 2007-10 period for each CLTV and FICO score combination as described in Chart 12 of this paper.

Special Offers Just a Click Away. SP Dow Jones Indices and Experian has released its latest SPExperian Consumer Credit Default Indices which found that in April 2021 the composite. Stood at almost 12 trillion US.

Delinquency and transition rates and their year-over-year changes were as follows. Add to Data List Add to Graph Expand All Collapse All Q1 1985 Q4 2022. Web This severity level is estimated to increase short term average state-level default rates from 007 to between 116 and 184 with a conservative estimate of 138.

Consequently we can approximate between 64000 and a little over 100000 mortgages will be at risk of a default in Louisiana over the next few months. Web First Mortgage Default Rates Slide in April. Web The general composite rate of defaults of first mortgages credit cards and automotive loans also remained steady at 039 down from 063 from September 2020.

Web Page 3 of 12 Category Purchase adjustment factor Rate-and-Term Refinance adjustment factor Cash-Out Refinance adjustment factor 15-year loan 040 040 040. 11 down from 15 in July 2020. Serious Delinquency 90 days or more past due including loans in.

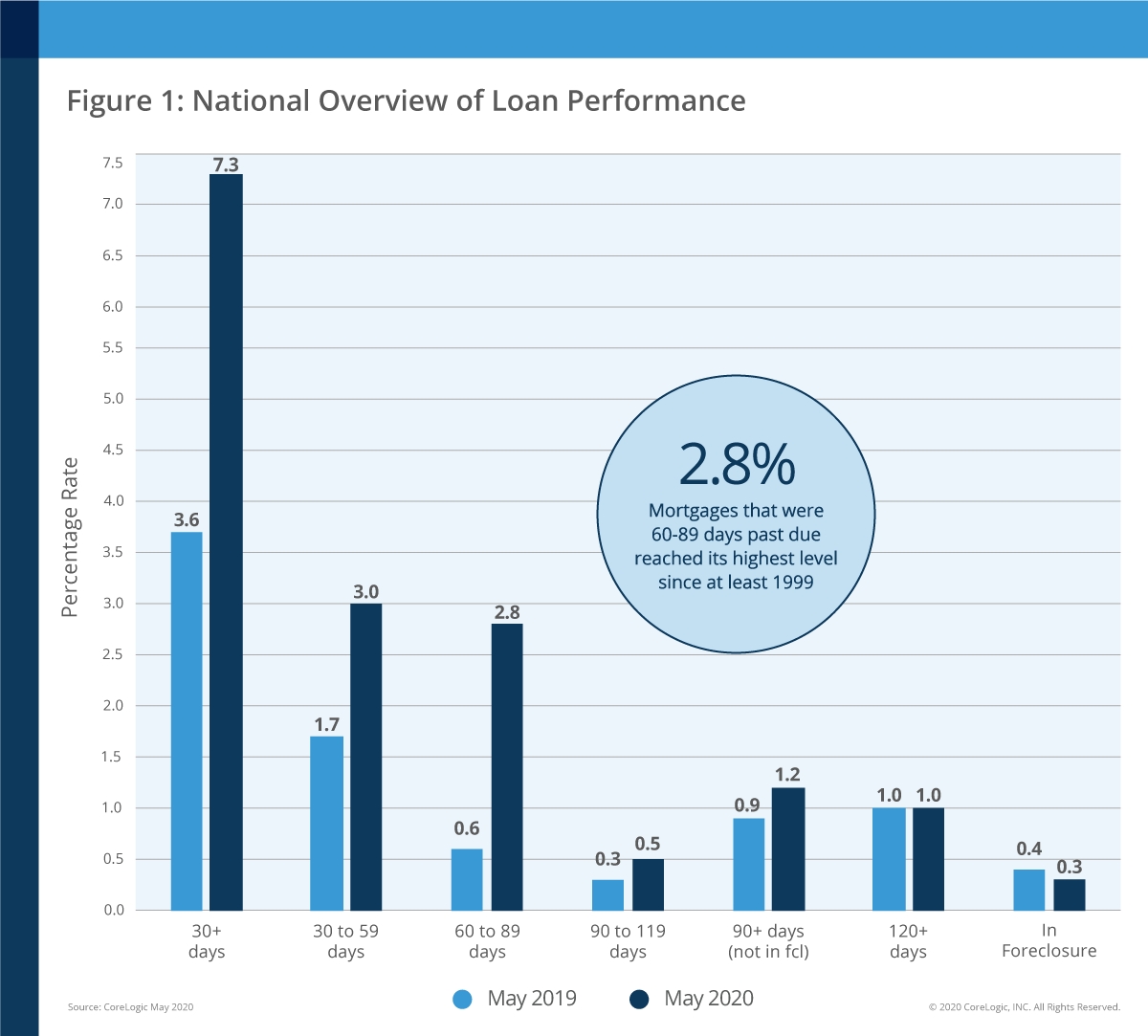

As shown in Exhibit 1 the delinquency rate. Web We have lowered our 2021 leveraged loan LL and high-yield bond HY default rate forecasts to 45 and 35 respectively from a range of 7-8 for LL and 5-6 for HY with total volume of defaults approximating 65 billion for. Early-Stage Delinquencies 30 to 59 days past due.

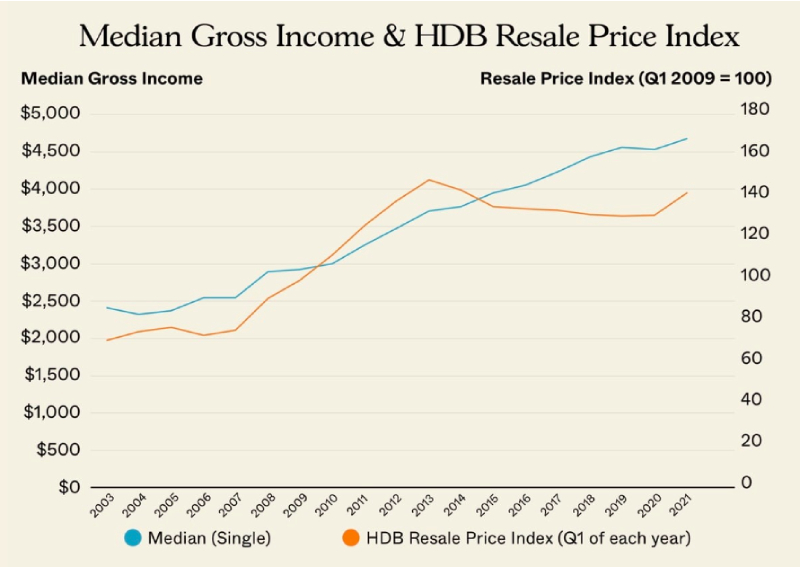

Modifications were canceled by the thousands in the first half of 2010 as a result of delinquent. As interest rates rose in the second quarter Q2 of 2021 total mortgage originations declined. Department of Veterans Affairs VA and conventional loans were 71 42 and 15 respectively Figure 1.

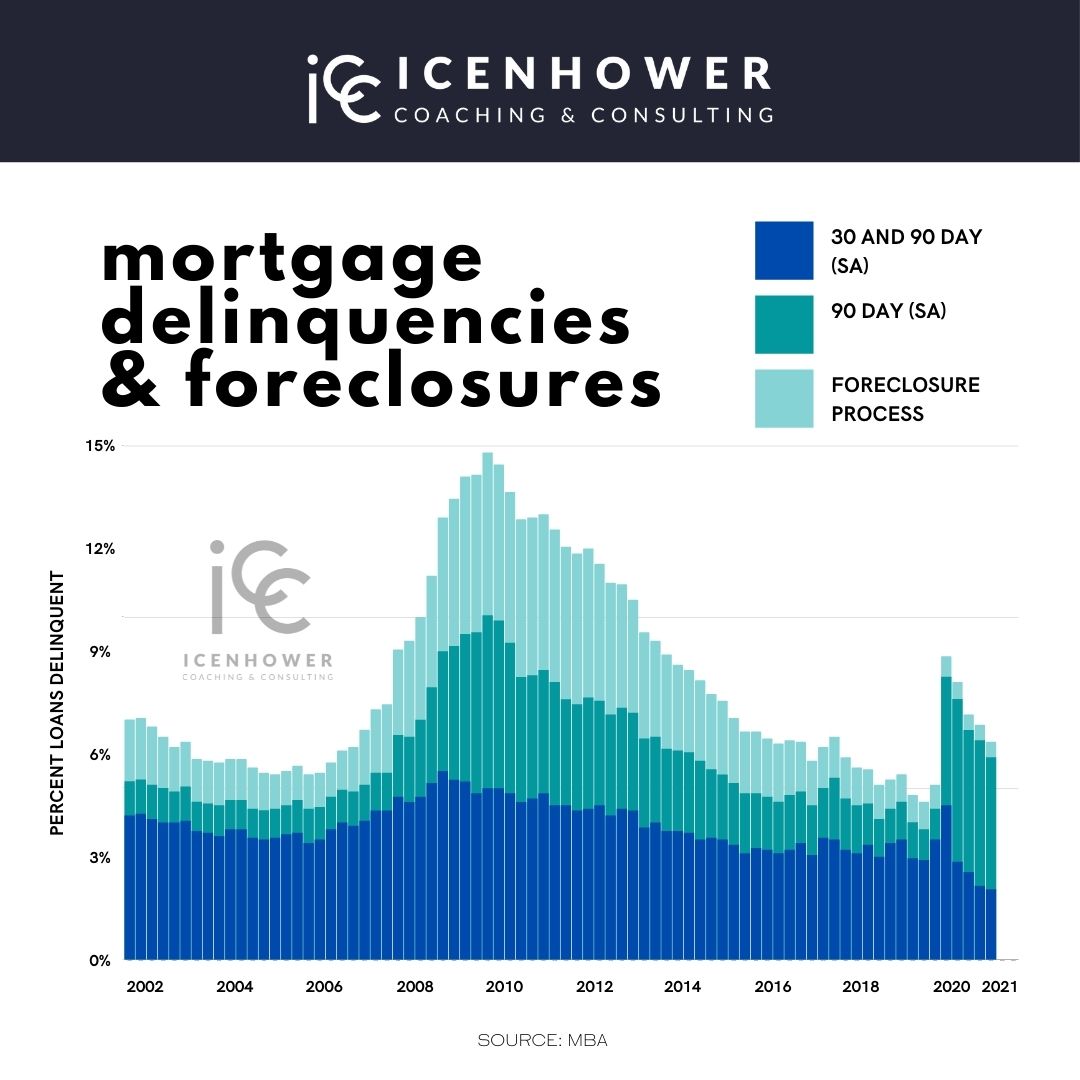

Web MBAs National Delinquency Survey NDS data for the second quarter of 2021 showed a sharp decline in the mortgage delinquency rate to 547. 03 down from 1 in July 2020. Adverse Delinquency 60 to 89 days past due.

Web The SPExperian first mortgage default index stood at 036 as of May 2022 meaning that based on data from the most recent three months the annualized share of default first mortgages was. We estimate that 39 percent of mortgage. Web The rate at which traditional mortgage accounts went into default rose another notch in May to a high not seen since March 2021.

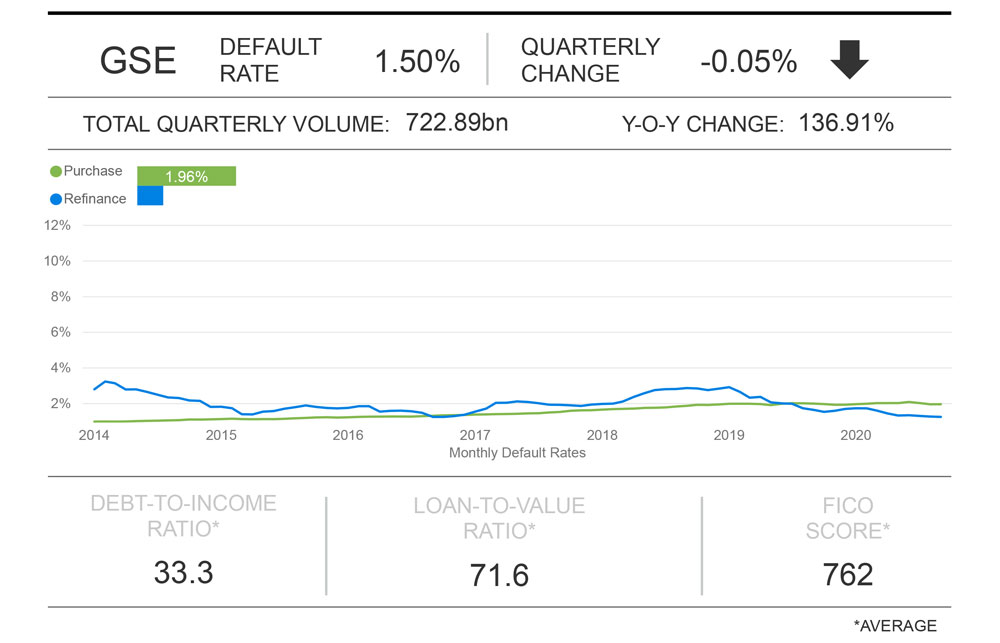

Get More Out Of Your Home Equity Line Of Credit. Ad Reviewed Ranked. Web This decrease has implications for the average default rate for new originations as refinance loans when they are rateterm refinances tend to have lower risk profiles relative to purchase originations.

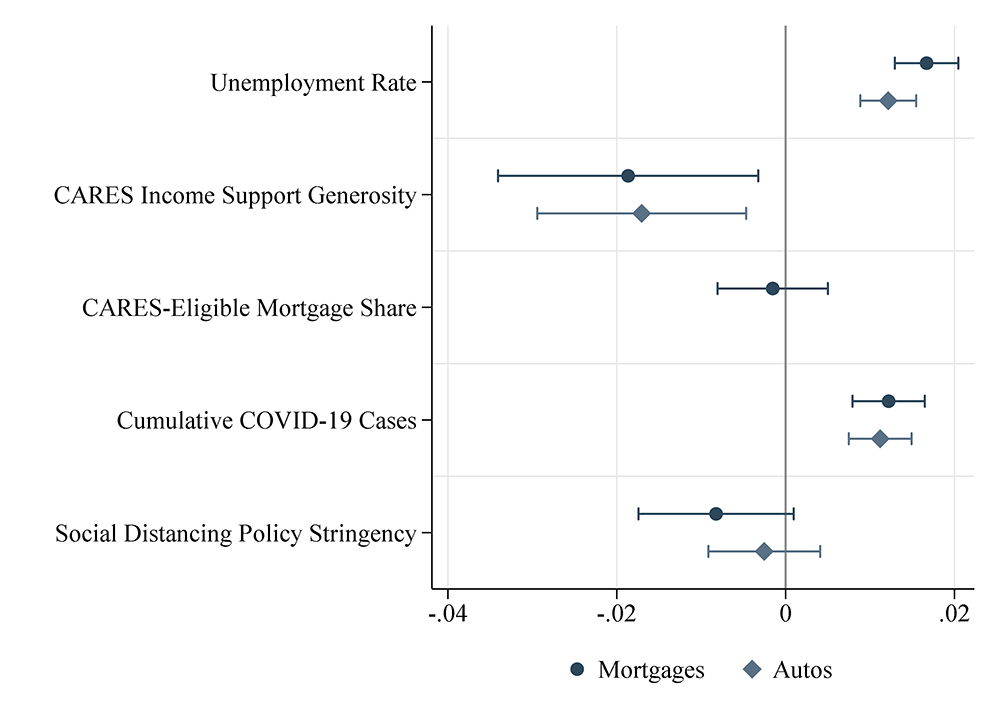

Web A one-standard-deviation increase in the index of CARES income support generosity is associated with delinquency andor forbearance rates on mortgages and auto loans that is about 2 percentage points lower or roughly a 25 percent reduction. Web Delinquency Rates for All Banks. Get A Free Information Kit.

Get A Free Information Kit. Web Loan product mixes also contribute to the national delinquency rate and this blog explores mortgage default trends by loan type. Subprime mortgages Subprime loans being targeted at high-risk borrowers and generally coupled with.

Free Info Kit For Homeowners Age 61. Web Its easy to forget weve been here before in the years after the Great Recession a similar federal mortgage modification program yielded a whopping 60 national re-default rate just one year after the modifications went into effect. 121 123 150 Residential Booked in Domestic Offices 177 185.

Name Q4 2022 Q3 2022 Q4 2021 Quarterly Seasonally Adjusted.

Mortgage Loan Delinquency Rates 2021 Chart Real Estate Coaches Icenhower Coaching

Residential Mortgage Default Forecasting How Much Do Price Trends Matter Collateral Analytics

U S Mortgage Delinquency Rate 2000 2022 Statista

First Mortgage Default Rates September Update Dsnews

The Fed Why Is The Default Rate So Low How Economic Conditions And Public Policies Have Shaped Mortgage And Auto Delinquencies During The Covid 19 Pandemic

Serious Mortgage Defaults Will Increase Fourfold By Mid 2021 Corelogic National Mortgage News

8hzsvtenxe5ukm

Great Graphic Mortgage Default Rates In Italy Spain And Portugal Marc To Market

Mortgage Delinquency Rates Record Low Is This The Calm Before The Debt Storm

Milliman Mortgage Default Index 2020 Q3

First Mortgage Default Rate Rises To High Not Seen Since March 2021 National Mortgage News

Mortgage Delinquency Rate Dropped To Lowest Level In Decades In Q3 Mortgageorb

Clouds On The Horizon For Many U S Homeowners Overall Delinquency Rates Beginning To Climb According To Corelogic Loan Performance Insights Report Business Wire

Mortgage Delinquencies Settled In 2021 But Are Looking Up In 2022

The Fed Why Is The Default Rate So Low How Economic Conditions And Public Policies Have Shaped Mortgage And Auto Delinquencies During The Covid 19 Pandemic

First Mortgage Default Rates September Update Dsnews

Coronavirus Mortgage Delinquency Rate Could Surpass Great Recession S National Mortgage News